Things You Must Know About Home Mortgages

Content written by-Dahl DunnHave you ever wanted to buy a home, but you were afraid of a mortgage? Maybe you're worried about taxes and insurance escrow? Perhaps you don't know how to find the right mortgage company and what is a good interest rate? All these questions are going through your mind, and this article is going to help you with a few tips to get you moving in the right direction.

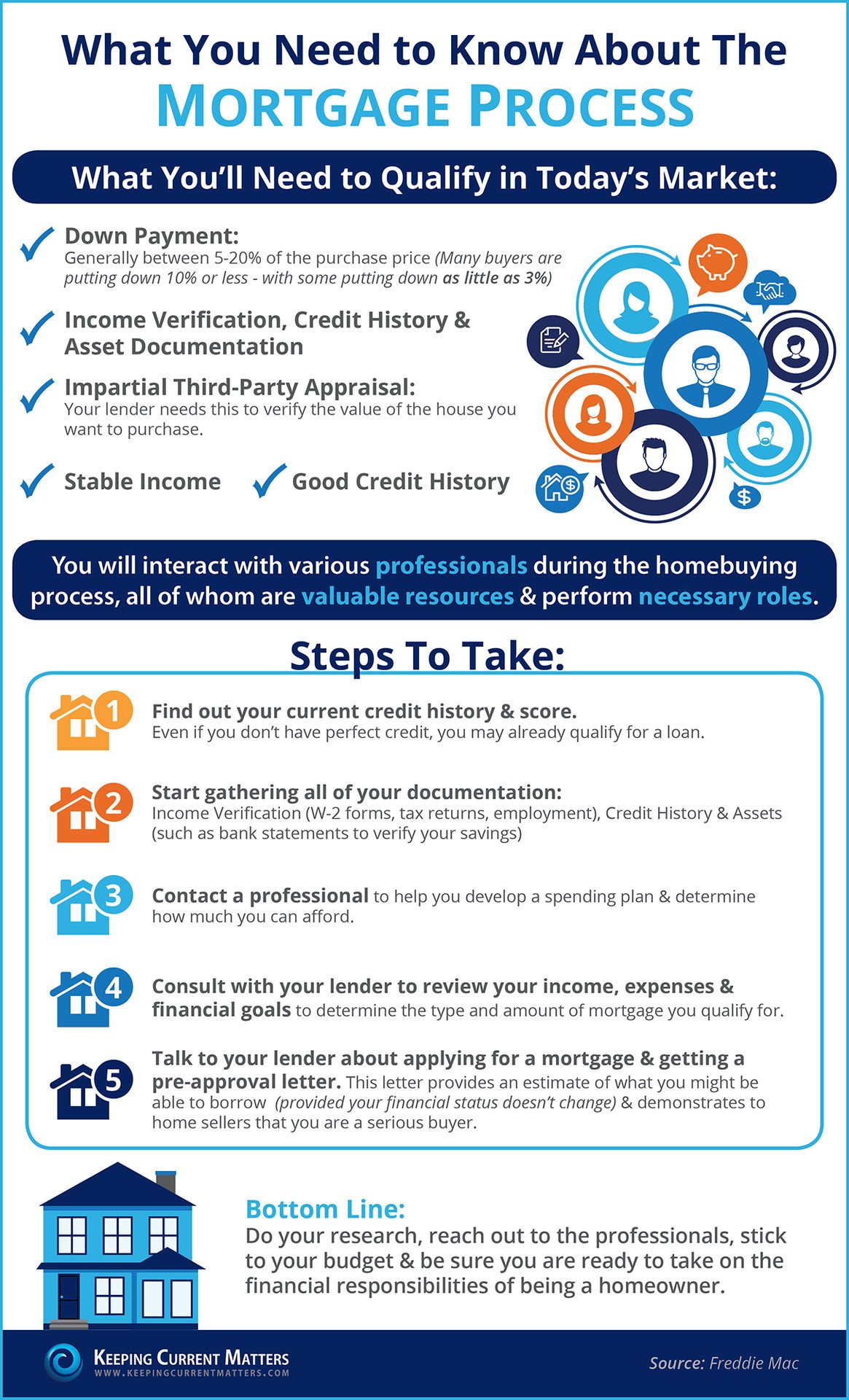

If you are planning on purchasing a house, make sure your credit is in good standing. Most lenders want to make sure your credit history has been spotless for at least a year. To obtain the best rate, your credit score should be at least 720. Remember that the lower your score is, the harder the chances of getting approved.

Avoid borrowing the most amount of money that is offered. The mortgage lender will tell you how much of a loan you qualify for, but that is not based on your life--that is based on their internal figures. You need to consider how much you pay for other expenses to determine how comfortably you can live with your mortgage payment.

Before applying for a mortgage, have a look at your credit report to make sure everything is okay. Your credit rating should be clean and free of errors. https://www.which.co.uk/news/2021/11/six-banking-app-features-that-can-help-you-keep-on-top-of-your-bills-and-subscriptions/ can help you qualify for a good loan.

Consider the Federal Housing Authority to be your first stop when looking for a new mortgage. In most cases, a mortgage with the FHA will mean putting a lot less money down. If you opt for a conventional loan, you will be required to come up with a serious down payment, and that can mean not being able to afford the home you really want.

Bring your financial documents with you when you visit lenders. Getting to linked web-site without your last W-2, check stubs from work, and other documentation can make your first meeting short and unpleasant. The lender wants to see all this material, so keep it nearby.

Adjustable rate mortgages, or ARM, don't expire when the term is over. Rather, the applicable rate is to be adjusted periodically. This creates the risk of an unreasonably high interest rate.

Remember that your mortgage typically can't cover your entire house payment. You need to put your own money up for the down payment in most situations. Check out your local laws regarding buying a home before you get a mortgage so you don't run afoul of regulations, leaving you homeless.

Keep in mind that not all mortgage lending companies have the same rules for approving mortgages and don't be discouraged if you are turned down by the first one you try. Ask for an explanation of why you were denied the mortgage and fix the problem if you can. It may also be that you just need to find a different mortgage company.

Know the risk involved with mortgage brokers. Many mortgage brokers are up-front with their fees and costs. Some other brokers are not so transparent. They will add costs onto your loan to compensate themselves for their involvement. This can quickly add up to an expense you did not see coming.

Many computers have built in programs that will calculate payments and interest for a loan. Use the program to determine how much total interest your mortgage rate will cost, and also compare the cost for loans with different terms. You may choose a shorter term loan when you realize how much interest you could save.

After your loan has gone through, you might find yourself tempted to let loose. Avoid making any changes to your financial situation until after your loan closes. Even after you secure a loan, the creditor could check out your credit score. A loan can be denied if you take on more debt.

Work with mortgage brokers if you have trouble getting a loan from a credit union or bank. A mortgage broker can usually find a lender who might be able to work with someone that fits your criteria. They work directly with the lenders and may be able to help.

If your mortgage application is denied, do not give up. Banks follow their own lending standards and another bank may accept you. Keep in mind that lending standards are much stricter than they were a decade ago, though. When you are turned down, ask why. Then work on fixing that problem.

If you have previously been a renter where maintenance was included in the rent, remember to include it in your budget calculations as a homeowner. A good rule of thumb is to dedicate one, two or even three perecent of the home's market value annually towards maintenance. This should be enough to keep the home up over time.

Before you select a mortgage broker, do a check at the BBB. There are predatory brokers that can trick you into loans with higher fees and some refinancing options that earn them higher fees. Be wary of any broker who demands that you pay very high fees or excessive points.

Don't feel relaxed when your mortgage receives initial approval. Avoid making any changes to your financial situation until after your loan closes. Even after you secure a loan, the creditor could check out your credit score. If you open up a new credit account or get a car loan, the lender can cancel the home loan.

How flexible is the payment schedule being offered to you? With greater flexibility comes the ability to pay off your mortgage more quickly, but it may also include higher interest rates. Consider how much you will spend over the entire life of the mortgage as you compare your options.

The ideas in this article have taught you the best practice when it comes to getting a mortgage. You have no reason to feel overwhelmed by the process now that you know how to get the job done right. Take your time, utilize each tip and turn your mortgage journey into a positive outcome.